Financing Airport Projects:

Airport projects require innovative financing models to boost efficiency and competitiveness amid rising costs and competition. Collaboration between private firms and governments drives such trade in a globalized economy. This guide outlines modern financing methods like project finance (PF) and public-private partnerships (PPPs), key trends, and benefits.

Evolution of Airport Financing

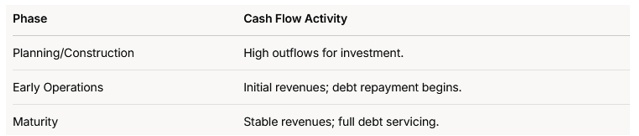

Traditional public funding for airports has shifted due to escalating infrastructure costs. Governments and private entities now use complex financial models, including long-term loans, bonds, grants, and PF instruments

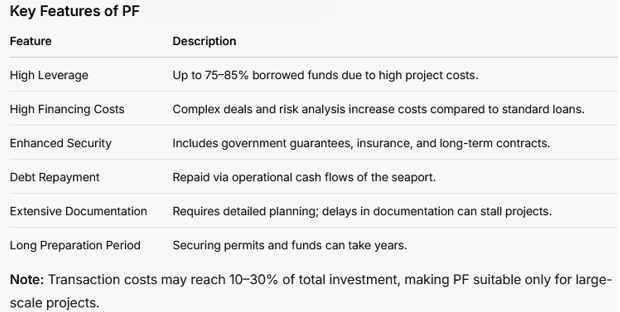

Benefits of PF

- High debt capacity (up to 80% of costs).

- Isolates project risks from initiators via Special Purpose Vehicles (SPVs).

- Links financing to future cash flows, not current sponsor finances.

- Enhances creditor confidence through transparent structures.

- Offers tax and investment incentives.

Structure of PF

A typical PF setup involves an SPV to isolate project assets and risks. Key participants include sponsors, lenders, and governments. SPVs, often structured as joint-stock companies, ensure transparency and limit recourse to shareholders.

Current Trends in Airport Funding

Shift to Private Capital

Western Europe increasingly transfers port infrastructure ownership to private entities, maintaining public oversight via PPPs. This trend extends to Central/Eastern Europe, Asia, Africa, and Latin America, driven by public funding deficits.

Public-Private Partnerships (PPPs)

PPPs combine state control with private initiative, offering flexibility in:

- Building new airports and terminals.

- Expanding or modernizing existing infrastructure. Private firms often manage and co-finance projects under long-term leases (25–30+ years), covering:

- Water area setup (channels, anchorages).

- Breakwaters and berthing lines.

- Storage areas, access roads, and railways.

Revenue Models

Ports earn via tonnage fees and reduced rents, while lessees profit from transshipment and storage services. Mixed models split costs between public and private parties.

Regional Insights

Studies from the European Bank for Reconstruction and Development highlight growing private investment in developing regions. EU funds are expected to further support airport projects, encouraging co-financing.

Services Offered by Phaeron Transformative Ventures

PNTV provides tailored financing for airport projects globally (Europe, USA, Canada, Latin America, Asia, Middle East, Australia). Services include

- Loans of €50M+ with up to 20-year terms.

- Combined PF instruments to protect originator assets.

- Financial modeling, SPV setup, and consulting.

For inquiries, contact PNTV representative