Commercial and Industrial Bank Loans for Hydropower Plants

Hydropower remains a cornerstone of renewable energy, constituting about 50% of global installed renewable capacity. It drives economic growth while supporting the shift from fossil fuels and nuclear power. Phaeron Transformative Ventures provides tailored financing for hydropower projects worldwide, focusing on long-term loans, project finance, and consulting.

Importance of Hydropower and Financing Needs

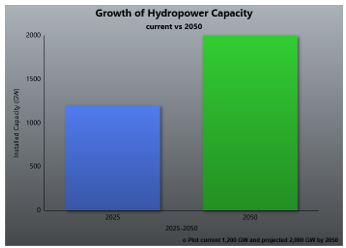

Hydropower plants (HPPs) are engineering marvels requiring billions in investment and years of planning. Currently, global installed capacity stands at 1,200 GW, with the International Energy Agency projecting growth to 2,000 GW by 2050.

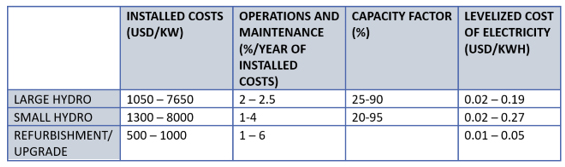

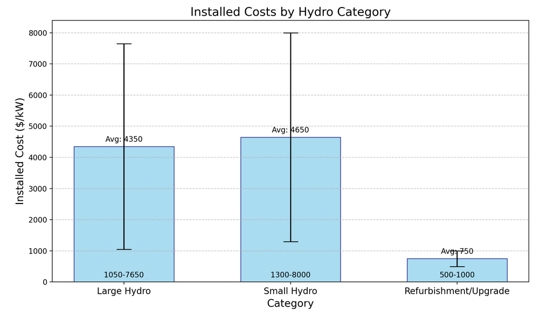

Costs can vary, driven by advanced technology, scarce suitable sites, environmental measures, and biodiversity protection. Large HPPs offer better cost-per-MW but face location constraints, while small HPPs (up to 20-30 MW) provide local benefits.

Average investment costs for large hydropower plants with storage typically range from as low as USD 1 050/kW to as high as USD 7 650/kW while the range for small hydropower projects is between USD 1 300/kW and USD 8 000/kW. Adding additional capacity at existing hydropower schemes or existing dams that don’t have a hydropower plant can be significantly cheaper, and can cost as little as USD 500/kW.

Challenges in Hydropower Development

Modern HPPs demand advanced technology—new turbines, digital control systems, and cloud computing—alongside significant earthworks, reservoir construction, and environmental compliance. These factors increase costs and necessitate robust financing. Long-term bank loans, often backed by government guarantees and international institutions, are critical for uninterrupted funding, especially during early-stage development.

Types of Bank Financing for Hydropower

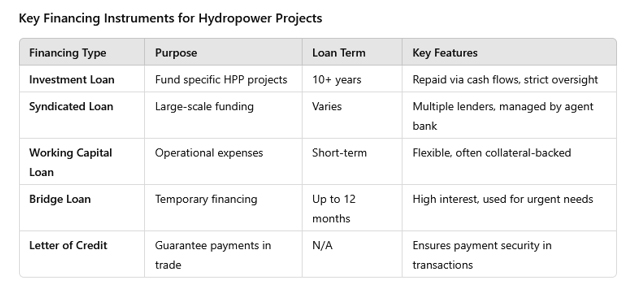

Hydropower projects rely on various financing instruments:

- Investment Loans: Long-term loans (10+ years) tailored for specific projects, repaid through cash flows from electricity sales. Interest rates align with project profitability, and banks enforce strict spending oversight.

- Syndicated Loans: Multiple lenders fund a single project under one agreement, managed by an agent bank. Common for large HPPs due to high capital needs.

- Commercial and Industrial (C&I) Loans: Include working capital lines, asset-based loans, bridge loans, and letters of credit. These address short-term needs or specific transactions like equipment purchases or international trade.

Role of Government and International Support

Governments play a key role by providing loan guarantees and regulatory oversight, given hydropower’s strategic importance. It accounts for 80% of global grid balancing capacity through pumped storage, making it vital for integrating unpredictable renewable sources.

Phaeron Transformative Ventures’ Offerings

Phaeron Transformative Ventures offers comprehensive financial solutions for hydropower projects globally, including:

- Long-term loans and project finance.

- Support for small and large HPPs across regions like Europe, the USA, Latin America, Africa, the Middle East, and Asia.

We also finance related sectors such as solar, wind, thermal power, and seaport infrastructure. Contact us for consultations or to apply for financing with a project brief.