Financing LNG Plant Projects

Global demand for liquefied natural gas (LNG) is surging, driven by economic and geopolitical factors. Nations like the US, Australia, and Qatar, alongside companies such as Shell and Total, are investing heavily in LNG plants. New financing models and instruments are emerging to support these capital-intensive projects. Phaeron Transformative Ventures (PNTV) offers comprehensive services for LNG project financing, including long-term loans, project finance (PF) schemes, credit guarantees, investment engineering, consulting, financial modeling, project management, and EPC contracting. PNTV operates globally, covering regions like Spain, Germany, USA, Mexico, Brazil, and Saudi Arabia.

Project Finance (PF) for LNG Plants

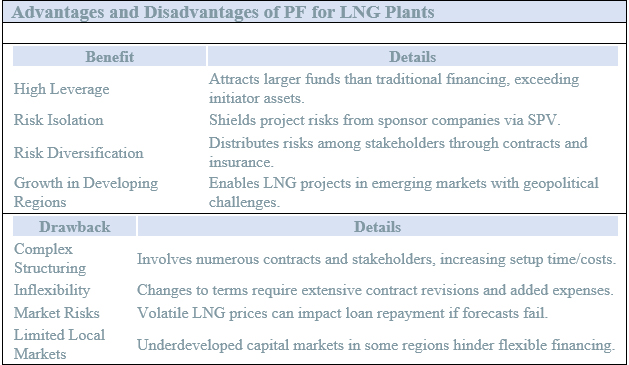

PF for LNG plants involves creating a Special Purpose Vehicle (SPV) to isolate the project and secure funds against future cash flows. This method suits the high capital needs and long timelines of LNG projects, requiring collaboration among banks, companies, and governments to ensure a stable legal and risk framework.

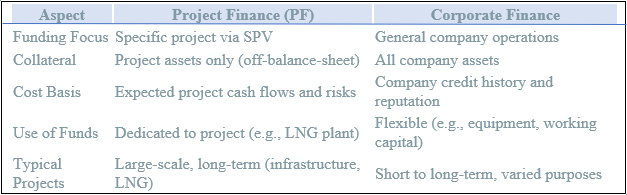

PF vs. Corporate Finance

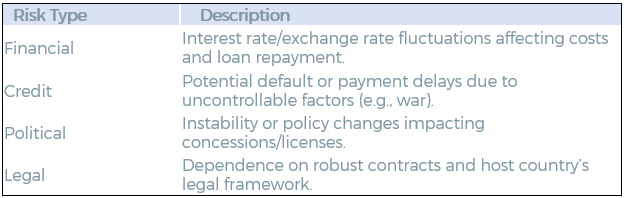

Risk Management in LNG Plant Financing

LNG projects face unique risks due to technical complexity, environmental concerns, and high costs. Effective risk management includes:

- Identifying and assessing risks (qualitative and quantitative).

- Developing preventive measures and contingency plans.

- Allocating financial reserves for adverse events.

- Ongoing monitoring and implementation.

PNTV Services

PNTV provides tailored solutions for LNG projects worldwide, including:

- Long-term financing (up to 20 years).

- PF schemes, monetizing government loan guarantees.

- Risk management and consulting.

Contact PNTV to explore financing options or submit a project brief.