Battery Energy Storage Systems (BESS) Market: Trends, Revenue Models, and Future Outlook

The Battery Energy Storage Systems (BESS) market is expanding rapidly, fueled by the global shift to renewable energy, grid modernization, and technological advancements. This write-up explores key market trends, revenue models, and the future outlook for the sector.

Market Trends

- Rapid Growth Driven by Renewable Energy Integration

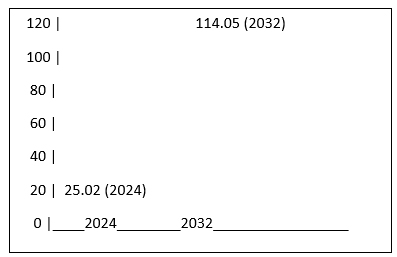

BESS is critical for integrating intermittent renewable energy sources like solar and wind into the grid, providing services such as frequency regulation and load shifting. The global BESS market, valued at $25.02 billion in 2024, is projected to grow at a CAGR of 24.7%, reaching $114.05 billion by 2032. Annual installations are expected to surpass 400 GWh by 2030, a tenfold increase, driven by cost declines and policy support like the U.S. Inflation Reduction Act.

- Lithium-Ion Dominance and Technological Advancements

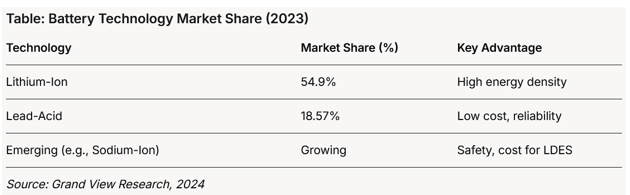

Lithium-ion batteries, particularly lithium iron phosphate (LFP), dominate with a 54.9% market share in 2023, due to their high energy density and declining costs (20% drop in 2024). Innovations like CATL’s 500 Wh/kg “condensed” battery and Tesla’s 4680 cells aim to further enhance efficiency and reduce costs by over 50%. Emerging technologies, such as sodium-ion and iron-air batteries, are also gaining traction for long-duration storage (8-12 hours).

- Utility-Scale Expansion and Grid Modernization

Utility-scale BESS is the fastest-growing segment, expected to grow at 29% annually through 2030, potentially accounting for 90% of the market share with 450-620 GWh in annual installations. Projects like virtual power plants and demand response programs enhance grid resilience, particularly in regions like California, which reached 13 GW of capacity in 2024. [Web ID: 0] [Web ID: 15]

- Regional Leadership and Policy Support

Asia-Pacific leads the market, with China accounting for two-thirds of global BESS deployments, driven by renewable energy adoption. North America follows with a 44.3% share in 2024, supported by U.S. policies and investments, while Europe sees rapid growth due to REPowerEU and the energy crisis.

Revenue Models

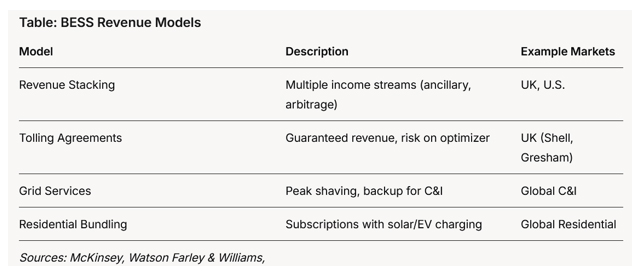

BESS operators employ diverse revenue models to maximize profitability across applications:

- Revenue Stacking

Utility-scale BESS providers combine income from ancillary services (e.g., frequency control), energy arbitrage, and capacity auctions, especially in markets like the UK. - Tolling Agreements

In mature markets, developers use tolling agreements to secure guaranteed revenue streams, shifting trading risks to optimizers, as seen with Shell and Gresham House in the UK. [Web ID: 17] - Grid Services and Backup Power

Commercial and Industrial (C&I) BESS generate revenue through peak shaving, load shifting, and backup power, often integrated with renewable sources like rooftop solar. [Web ID: 1] - Residential Subscriptions and Bundling

Residential BESS are bundled with solar panels or EV charging systems, offering subscriptions for energy independence and optimized consumption, with global revenues expected to reach $8.11 billion by 2030.

Future Outlook (2025–2035)

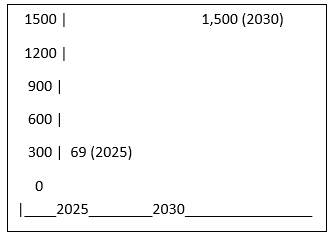

- Market Size Growth: The global BESS market is forecasted to reach $204.8 billion by 2033 (CAGR 14.8%), with some estimates as high as $109 billion for Li-ion BESS alone by 2035. Capacity is expected to hit 1,500 GW by 2030, per the COP29 Pledge. [Web ID: 7] [Web ID: 16]

- Technological Evolution: Advances in long-duration energy storage (LDES), such as redox flow and metal-air batteries, will complement lithium-ion for utility-scale applications. AI integration will optimize performance and efficiency. [Web ID: 4]

- Regional Dynamics: North America and Asia-Pacific will remain leaders, with the U.S. market growing to $70.7 billion by 2033 (CAGR 13.9%). Europe’s capacity is projected to ramp up significantly, driven by renewable targets. [Web ID: 16] [Web ID: 18]

- Challenges and Opportunities: Declining battery costs and supportive policies will drive adoption, but challenges like market volatility, safety concerns (e.g., thermal runaway), and supply chain dependencies (e.g., reliance on Chinese imports) remain. Innovations in safety, such as early thermal runaway detection, will be critical.

Conclusion

The BESS market is thriving, driven by renewable energy integration, technological advancements, and supportive policies. Diverse revenue models, from stacking to tolling agreements, are enabling scalability across utility, C&I, and residential segments. Looking ahead, the market’s trajectory points to significant growth, with innovations in LDES and AI set to enhance efficiency, though addressing safety and supply chain challenges will be key to sustaining momentum in the global energy transition.