Carbon Credits: An Overview

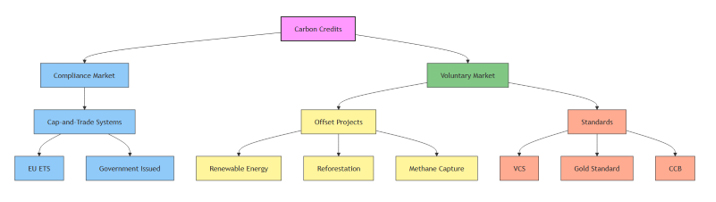

Carbon credits are tradable certificates representing the right to emit one ton of carbon dioxide (CO2) or equivalent greenhouse gas (CO2e), or the removal of the same amount from the atmosphere. They operate in two primary markets: compliance and voluntary, each serving distinct purposes in combating climate change.

Markets for Carbon Credits

Compliance Market

In compliance markets, governments enforce cap-and-trade systems, setting emission limits for industries. Companies reducing emissions below their cap earn credits, which they can sell to others exceeding their limits. Examples include the European Union Emissions Trading System (EU ETS).

Voluntary Market

Voluntary markets involve entities purchasing carbon offsets to achieve carbon neutrality or support sustainability without legal mandates. Projects include renewable energy, reforestation, and community development.

Types of Carbon Credits

Carbon credits vary by market origin, project type, and certification standards.

By Market Origin

- Compliance Credits: Issued under cap-and-trade systems (e.g., EU ETS credits).

- Voluntary Offset Credits: Generated by projects like renewable energy or reforestation.

By Project Type

- Renewable Energy Credits (RECs): Represent one MWh of renewable energy, supporting clean energy development.

- Carbon Sequestration Credits: From projects like reforestation or carbon capture and storage (CCS).

- Methane Capture Credits: Prevent methane release from landfills or livestock.

- Avoided Emissions Credits: Prevent emissions through alternatives like renewable energy replacing fossil fuels.

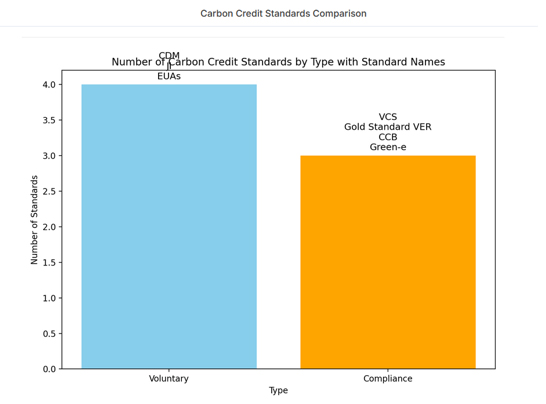

By Certification Standards

- Certified Emission Reduction (CER): Kyoto Protocol-compliant, verified by the UN (e.g., Clean Development Mechanism – CDM).

- Verified Carbon Standard (VCS): Ensures real, measurable emission reductions.

- Gold Standard: Focuses on sustainable development alongside emission reductions.

- Climate, Community, and Biodiversity Standards (CCB): For land-based projects with environmental and social benefits.

- Green-e: US-based standard for renewable energy certification.

Verification and Issuance

Verification Process

- Compliance Market: Companies report emissions, verified by accredited third-party auditors under regulatory oversight (e.g., EU ETS).

- Voluntary Market: Projects undergo validation (initial design review) and periodic verification against standards like VCS or Gold Standard.

Issuance

- Compliance: Governments or regulatory bodies issue credits based on verified emissions data.

- Voluntary: Non-governmental bodies (e.g., CDM under the UN) or project developers issue credits post-verification.

Creation of Carbon Credits

Carbon credits are calculated as: Carbon Credits = Carbon Stock – Carbon Baseline

- Carbon Stock: Amount of carbon stored (e.g., in trees for forestry projects).

- Carbon Baseline: Emissions in a “business-as-usual” scenario without the project. This calculation is repeated over a project’s lifecycle, with changes impacting credit issuance.

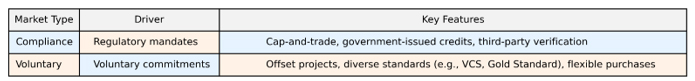

Standards Overview

Visualizing Carbon Credit Impact

This diagram illustrates the structure of carbon credit markets, highlighting the division between compliance and voluntary systems, and the types of projects and standards involved.

Phaeron Transformative Ventures (PNTV) is actively involved in the carbon credit sector, primarily with various sovereign nations for nopal cactus sequestration projects and forest conservation. Contact your PNTV representative to discuss your sovereign project and various other opportunities in the carbon credits markets.