Data Center Trends and Revenue Models

The data center industry in the near future will evolve under AI-driven growth, energy constraints, and technological innovation. Data Center Frontier, using AI tools and expert insights, highlights eight key trends shaping the sector, alongside emerging business models.

Rising Energy Demands Strain Infrastructure

AI is pushing data center energy consumption from 536 TWh in 2025 to 1,065 TWh by 2030 (Deloitte), challenging grid reliability and urban land use (e.g., Atlanta). Regulations, like Ireland’s Dublin moratorium until 2028, aim to curb usage, while emissions could double by 2030 without renewable growth (S&P Global).

Graph: Data Center Energy Consumption (TWh)

1200 | 1,065

1000 |

800 |

600 | 536

400 |

200 |

0 |____2025________2030_________________

Natural Gas Bridges Energy Needs

Natural gas, emitting 117 lbs CO₂/MMBtu versus coal’s 210 lbs (EIA), will support data centers transitioning to hydrogen and nuclear power. Demand may hit 6 bcf/d by 2030 (S&P Global), with projects like ExxonMobil’s 1.5 GW plant, though methane leakage poses environmental risks.

Fuel | CO₂ Emissions |

Natural Gas | 117 |

Oil | 160 |

Coal | 210 |

Source: EIA, 2024 |

AI Integration Faces GPU Risks

Hyperscalers (AWS, Google) are embedding AI into operations and developing chips like NVIDIA’s Blackwell GPUs. However, GPU overbuilding risks depreciation, energy strain, and overcapacity if AI demand slows. Operators must diversify hardware and prioritize ROI to mitigate risks.

Hyperscale Expansion Relies on Utilities

Hyperscale data centers grew 24% in U.S. supply in 2024 (CBRE), with mega-campuses like Lancium’s 6 GW Texas project. Utility partnerships, such as Microsoft’s Three Mile Island restart with Constellation Energy, ensure power for AI workloads, often through hyperscale business models.

Costs Push Growth to Secondary Markets

High rental rates, 90% preleasing, and 2.8% vacancy (CBRE) drive development to secondary markets like Columbus, OH, and Raleigh-Durham, NC. These areas offer affordable land and policies, as seen with Meta’s $10 billion Louisiana campus, often leveraging colocation or hyperscale models.

Emerging Data Center Markets

Market | Advantages |

Columbus, OH | Affordable land, fiber access |

Raleigh-Durham, NC | Skilled workforce, supportive |

San Antonio, TX | Low disaster risk, cheap energy |

Liquid Cooling Gains Traction

Liquid cooling, vital for AI and HPC, will grow from $4.9B in 2024 to $21.3B by 2030 (CAGR 27.6%, MarketsandMarkets). Direct-to-chip cooling dominates, but immersion cooling could cut energy use by 30%, despite cost and regulatory challenges.

25 | 21.3

20 |

15 |

10 |

5 | 4.9

0 |____2024________2030_________________

AI Edge Spurs Modular Growth

AI inference at the edge requires low-latency, modular data centers. Prefabricated designs by Equinix and Vertiv enable rapid deployment in cities like Salt Lake City, with edge computing potentially driving 30% of 2025 growth for applications like telemedicine and AR/VR, often using edge data center models.

Quantum Computing Approaches Viability

Quantum computing is nearing practical use in optimization and cryptography, with a market projected at $14B by 2028. IBM, Google, and AWS offer cloud-based quantum services, but qubit stability and costs remain hurdles. Quantum-as-a-Service (QaaS) may emerge as a new revenue model.

Additional Trends to Monitor

- Sustainability: Focus on energy efficiency.

- Workforce Growth: Expanding skilled labor.

- Digital Twins: Improving operations via simulations.

- Cybersecurity: Enhancing data protection.

- Energy Storage: Advancing battery backups.

- Nuclear Power: Exploring SMRs and microreactors.

- Onsite Power: Sustainable energy generation.

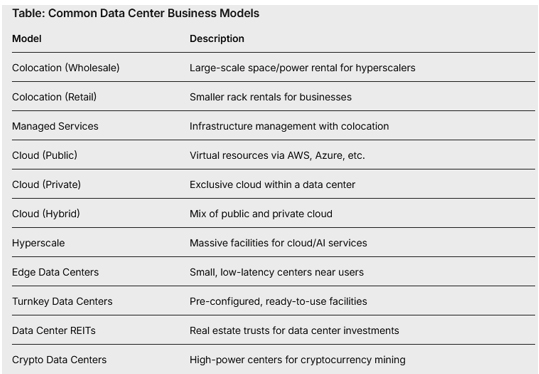

Data Center Business Models

The industry operates through diverse models, each catering to specific needs and scales, often influencing the trends above (e.g., hyperscale growth, edge deployment).