Financing Public-Private Partnership (PPP) Projects

Public-private partnerships (PPPs) enable significant investments and efficient use of government support for large-scale projects. We offer project finance and investments starting at $50 million or €50 million, with loan terms up to 20 years.

Overview of PPPs

PPPs facilitate resource attraction for capital-intensive projects in critical sectors like infrastructure, environment, and agriculture. Globally, they shift infrastructure responsibilities from governments to private entities, addressing budget constraints while meeting societal needs. PPPs involve complex contracts tailored to project specifics, blending equity and debt based on agreements among stakeholders.

Financing Trends

- Developed Countries: Favor equity, long-term loans, bonds, and mezzanine financing.

- Developing Countries: Rely on equity, international loans, and limited bond use due to higher risks and costs.

Lending remains the most common PPP funding method, supported by state mechanisms, though banking weaknesses have increased costs and shifted reliance toward international financial institutions (IFIs). In the mid-2010s, Eurostat reported equity at 5% for healthcare/education PPPs and 20% for infrastructure, with loans covering 70-80% of infrastructure projects. Basel III regulations reduced banks’ long-term PPP lending capacity, boosting syndicated loans to distribute risks.

Major creditors include European, U.S., and Asian banks, with growing investment in Asia alongside traditional markets like Europe and the U.S.

Global PPP Trends

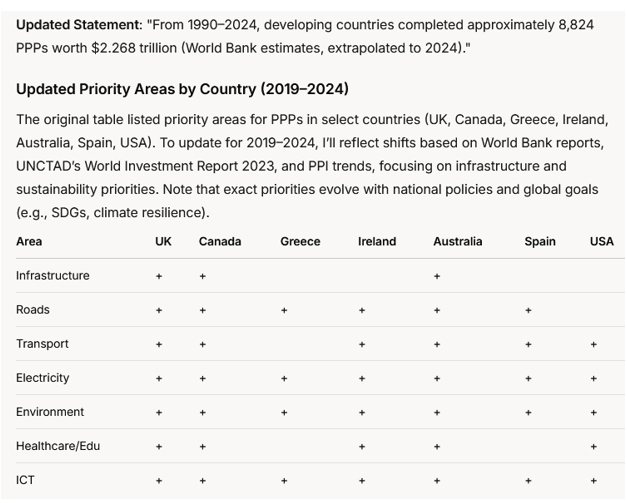

- Growth: Since the late 20th century, PPP projects have surged, especially in India, Brazil, Mexico, and China. The EU implemented 1,700 projects worth €318 billion from 1990-2013.

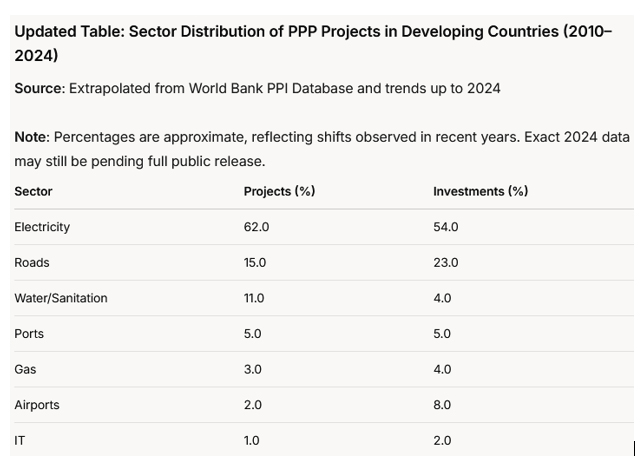

- Diversification: Post-2006, sectors like water management and waste recycling expanded, alongside healthcare in developing regions.

- Infrastructure Focus: The U.S., Canada, Australia, and Asia prioritize infrastructure, with Asia emphasizing social benefits.

- State Support: Governments target key sectors (e.g., transport, energy) for PPPs.

- Innovation: Programs like the U.S. SBIR (1982) use PPPs to drive research.

From 1990-2018, developing countries completed 7,205 PPPs worth $1.788 trillion (World Bank).

Financing Mechanisms

- Concessions: BOT, BTO, BOOT, BOMT models offer long-term stability and guaranteed markets.

- Outsourcing: Reduces costs by 35% and boosts ROI by 5-6%.

- Leasing: Medium-term partnerships for maintenance.

- IFIs/Development Banks: Post-2008, IFIs funded 8-10% of PPPs, peaking at 28% of capital. They offer long-term loans, tax benefits, and risk reduction.

Alternative Instruments

- Project Bonds: Issued via SPVs, backed by state guarantees to lower costs.

- Mezzanine Financing: Subordinated loans or convertible bonds optimize capital structure, balancing cost and equity.

For financing in energy related projects contact Phaeron Transformative Ventures for comprehensive project support.