Guidance on Government Guarantees in Emerging Markets

This document provides strategic guidance for government officials in emerging markets and developing economies (EMDEs) on the effective use of government guarantees for public-private partnership (PPP) projects. It outlines when guarantees are appropriate, how to structure and manage them, and how to mitigate associated fiscal risks. The aim is to mobilize private financing for infrastructure while balancing risks and benefits, without promoting PPPs or guarantees indiscriminately.

Introduction to Government Guarantees

Government guarantees are sovereign commitments, formalized in binding or potentially binding documents, to cover specific obligations or losses in PPP contracts if predefined conditions occur. They enhance project bankability by reducing risks for private investors, particularly those beyond their control, such as political or regulatory changes. Guarantees are critical in EMDEs, where public budgets often fall short of infrastructure needs, and private sector expertise and capital can improve efficiency and service delivery.

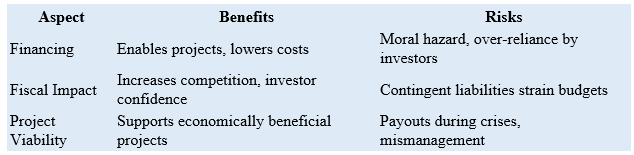

Key Benefits:

- Enable financing for projects otherwise unviable due to perceived risks.

- Reduce financing costs and attract more bidders, increasing competition.

- Signal government commitment, boosting investor confidence.

Key Risks:

- Moral Hazard: Overly broad guarantees may reduce private sector diligence, increasing government payouts.

- Fiscal Risks: Contingent liabilities may strain budgets, especially during economic crises when multiple guarantees are called.

Benefits vs. Risks of Government Guarantees

Types of Government Guarantees

Guarantees are categorized into two main types, each with distinct implications:

Financial Guarantees:

- Unconditional commitments to service debt if the borrower defaults.

- Rarely used in PPPs due to high fiscal risk and potential for unbalanced risk allocation.

- Example: Guaranteeing loans for subnational entities or state-owned enterprises (SOEs).

Performance Guarantees:

- Conditional commitments tied to specific risks or obligations in PPP contracts (e.g., payment defaults by an SOE).

- Preferred in PPPs as they allow governments time to remedy issues before payouts.

- Example: Guaranteeing utility payments under a power purchase agreement (PPA).

Payment Guarantees:

- Can be financial or performance-based, depending on structure.

- In PPPs, typically conditional, linked to performance standards (e.g., delivering electricity per PPA terms).

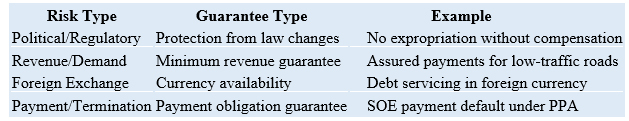

Figure 1: Types of Government Guarantees

Scope of Government Guarantees

Guarantees address risks that deter private investment, particularly those under government control or uninsurable by the market. Common risks mitigated include:

Political and Regulatory Risks:

- War, civil unrest, or expropriation.

- Adverse changes in laws, taxes, or regulations.

- Non-discriminatory application of government powers.

Revenue and Demand Risks:

- Minimum revenue guarantees.

- Availability or capacity payment assurances.

Foreign Exchange Risks:

- Availability of foreign currency for debt servicing.

- Protection against exchange rate fluctuations.

Payment and Termination Risks:

- Non-payment by SOEs or government entities.

- Compensation for early contract termination.

Risks Not Requiring Guarantees:

- Construction Risks: Managed by private contractors via engineering, procurement, and construction (EPC) contracts, except for government-controlled issues like land acquisition.

- Operational Risks: Handled by private operators under performance standards.

- Input Supply Risks: Commercial risks (e.g., fuel availability) unless managed by SOEs.

Risks and Corresponding Guarantees

Structuring and Negotiating Guarantees

Effective guarantee structuring requires clarity on legal enforceability, scope, and dispute mechanisms. Key considerations include:

Forms of Support:

- Guarantees: Explicit, binding contracts.

- Comfort Letters: Potentially binding, depending on language and jurisdiction.

- Language determines enforceability, not the document’s title.

Negotiation Elements:

- Scope: Specify covered risks (e.g., SOE non-payment, regulatory changes).

- Term: Align with project lifecycle (e.g., PPA duration).

- Cure Periods: Allow governments time to remedy defaults before payouts.

- Dispute Resolution: Include arbitration clauses with clear rules and forums.

- Sovereign Immunity Waiver: Ensure enforceability by waiving immunity for commercial transactions.

Government Rights:

- Step-in rights to resolve project issues.

- Access to timely project performance data to mitigate risks.

Role of Advisers:

- Engage technical, financial, and legal advisers to balance risk allocation.

- Advisers ensure government interests are protected against private sector demands.

Figure 2: Guarantee Structuring Process

Process Timeline

Managing Fiscal Risks

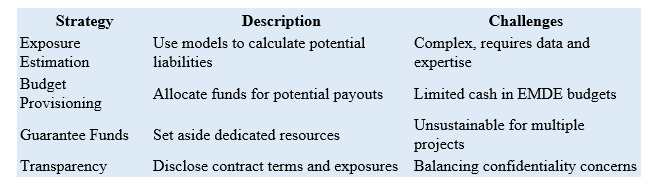

Guarantees create contingent liabilities, requiring robust management to avoid fiscal strain, especially during economic crises when multiple guarantees may be called.

Institutional Arrangements:

- Line ministries monitor projects and report risks to the Ministry of Finance (MoF).

- MoF assesses liabilities, approves guarantees, and ensures fiscal affordability.

Exposure Estimation:

- Calculate expected loss: Expected Loss = Exposure at Default (EAD) × Probability of Default (PD) × Loss Given Default (LGD).

- Use models like Monte Carlo simulations or credit ratings to estimate PD.

- Set exposure caps (e.g., percentage of GDP) to limit total liabilities.

- Budgeting and Funding:

- Provision for guarantee payouts in budgets via contingency lines.

- Establish guarantee funds for liquidity, though limited by funding sustainability.

- Borrowing to cover payouts is viable for isolated issues but risky during crises.

- Accounting:

- Shift from cash to accrual accounting to recognize contingent liabilities upfront.

- Record guarantees as liabilities if payout is probable (>50% likelihood).

- Disclosure:

- Publish PPP contract terms and guarantee exposures to enhance transparency.

- Disclose aggregate liabilities in budgets or financial statements.

Fiscal Risk Management Strategies

Guidelines for Effective Guarantee Use

To maximize benefits and minimize risks, governments should follow these principles:

Project Selection:

- Prioritize projects with high socio-economic returns, validated by feasibility studies.

- Assess suitability for PPPs based on value-for-money and financial viability.

- Align projects with sectoral and national development goals.

Risk Allocation:

- Target guarantees to risks under government control (e.g., regulatory changes).

- Avoid broad financial guarantees or unlimited exposure (e.g., foreign exchange risks).

- Ensure balanced risk allocation to prevent moral hazard.

Risk Management:

- Establish clear approval processes involving the MoF.

- Decide on guarantees early in project preparation, including them in bidding documents.

- Regularly evaluate and disclose contingent liabilities.

Set exposure limits to cap total liabilities.

Sectoral Reforms:

- Use guarantees as interim measures while pursuing regulatory and SOE reforms.

- Address underlying issues (e.g., tariff structures) to reduce long-term guarantee reliance.

Conclusion

Government guarantees are powerful tools to attract private investment for infrastructure in EMDEs, but they must be used strategically to avoid fiscal risks. By selecting viable projects, targeting specific risks, structuring guarantees carefully, and managing contingent liabilities transparently, governments can close infrastructure gaps while safeguarding public finances. Over time, sectoral reforms should reduce reliance on guarantees, fostering sustainable private sector participation