Financial Modeling for Hydroelectric Power Plants (HPPs)

Financial models are critical for securing funding and advancing renewable energy through hydroelectric power plants (HPPs). Phaeron Transformative Ventures offers project finance from $50M/€50M with loans up to 20 years, supporting global energy projects with hands on assistance.

Challenges and Importance

Building HPPs is increasingly complex and costly due to shrinking water resources and stricter environmental regulations. High-quality financial models are essential for attracting multimillion-dollar investments, providing accurate forecasts to unlock external financing. Costs typically exceed €2M per MW, factoring in reservoirs and environmental mitigation, necessitating robust planning over 5–7 years.

Financial Modeling Basics

A financial model evaluates HPP projects using assumptions and standard analytical methods to predict outcomes. Key principles include:

- Comprehensive coverage of project variables.

- Dynamic adjustments to key financial inputs.

- Separate modeling of revenues and costs.

- Alignment with real-world trends.

Forecasting Stages

- Define assumptions.

- Plan profit maximization (e.g., electricity sales).

- Forecast revenues and costs.

- Budget expenditures and funding sources.

- Project financial statements (P&L, cash flow).

- Assess capital costs, efficiency, and risks.

Expertise, data access, and technical tools are vital for handling the uncertainty inherent in long-term forecasts.

Financial Needs Analysis

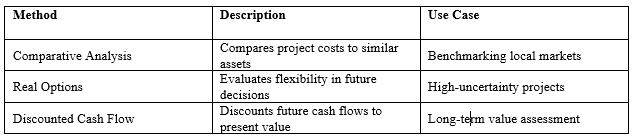

Assessing HPP viability requires modeling revenues, costs, and regulatory/market conditions. Asset valuation sets the foundation, using methods like:

Valuation Methods

- Costs: Civil works (50%+ for large projects), electromechanical equipment (key for small HPPs), plus pre-investment studies and licensing.

- Variations: Civil costs drop in low-labor-cost regions; equipment dominates small projects (<10 MW).

Real Options Approach

Real options assess flexibility (e.g., delaying or staging investments) to manage uncertainty. Unlike thermal plants, HPPs lack fuel flexibility, relying on site-specific conditions, with commercial flexibility tied to power purchase agreements (PPAs).

Discounted Cash Flow (DCF)

DCF measures value via future cash flows discounted by a risk-adjusted rate. Net Present Value (NPV) guides investment decisions:

- Positive NPV = Value increase.

- Negative NPV = Value decrease.

Free cash flow (FCF) reflects returns to lenders and investors, factoring in financial leverage.

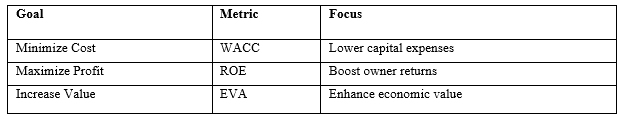

Capital Structure

Optimizing capital structure balances equity and debt, considering:

- Funding types and timelines.

- Resource needs and repayment schedules.

- Risk and cost minimization.

Optimization Goals

WACC is preferred for large HPPs due to simpler forecasting vs. ROE/EVA’s operational complexity.

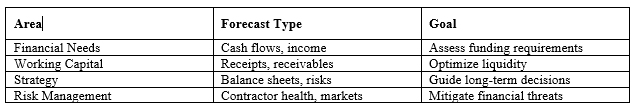

Forecasting Role

Financial forecasts reduce risks by predicting cash flows, sales, and material needs. They support:

- Project comparison and funding decisions.

- Working capital and liquidity management.

- Risk assessment (e.g., credit, market, regulatory)

Forecast Types and Goals

Services

Phaeron Transformative Ventures provides long-term financing for HPPs, ensuring comprehensive support from planning to execution.