Global Renewable Energy Sector: Solar Power Financing Insights

Market Growth and Trends

The renewable energy sector is expanding steadily. The Energy Outlook 2021 projects a 35 GW growth in Europe’s wind and solar PV market in 2021, requiring €60 billion in investments. The International Energy Agency forecasts an 8% growth for wind power and 13% for solar power. Solar power plants, once built, are the cheapest to operate due to free solar radiation and low maintenance costs, outcompeting fossil fuels. Technological advancements have made new solar plants more cost-effective than coal or nuclear plants, with supportive policies driving further growth.

Financing Solar Power Projects

Choosing the right financial model is critical for solar projects. Two primary options are long-term bank loans and project finance (PF), both suited for capital-intensive projects. Phaeron Transformative Ventures (PNTV) offers tailored solutions, including financing, technical documentation, and construction under EPC contracts, with a minimum initiator contribution of 20%. PNTV supports solar projects in Europe, the Middle East, USA, Latin America, Southeast Asia, and Africa.

Long-Term Bank Loans

Bank loans remain a popular financing method, contributing significantly to the $2.7 trillion invested in renewables over the past decade.

- Features:

- Terms: 5-7 years or more.

- Interest: Often variable, adapting to market conditions (e.g., indexed loans).

- Guarantees: Require collateral (e.g., securities, real estate) or guarantors, especially for large projects like a 100 MW plant costing $80-100 million.

- Syndicated Loans: Used for large projects to spread risk among multiple banks.

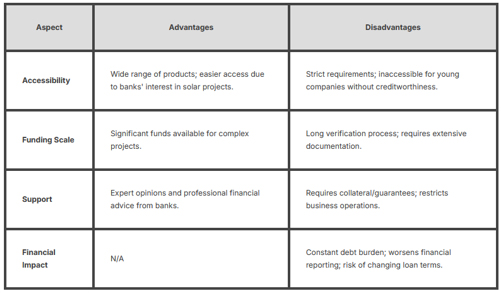

Advantages and Disadvantages of Bank Loans

Project Finance (PF) for Solar Projects

PF is ideal for large solar projects, enabling access to larger funds than traditional loans. A Special Purpose Vehicle (SPV) is created to manage the project, limiting the initiator’s liability. Debt repayment relies on project cash flows, with assets as collateral.

- Benefits:

- Off-balance sheet financing preserves the initiator’s creditworthiness.

- Attracts significant funds unavailable through traditional loans.

- Diversifies risks among participants (e.g., investors, contractors).

- Involves government and institutions for oversight.

- Challenges:

- High costs of setup and risk diversification.

- Technical risks (e.g., unpredictable solar radiation).

- Economic risks (e.g., declining energy prices post-guaranteed period).

- Political risks (e.g., policy changes, reduced incentives).

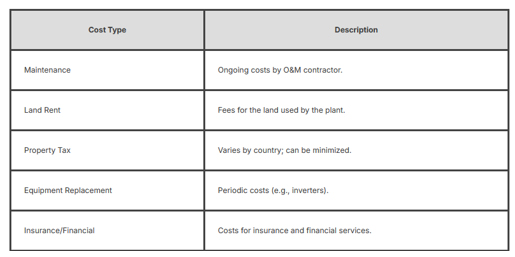

Cost of a 1 MW Solar Power Plant

The cost of a 1 MW solar plant varies from $750,000 to $1.35 million, depending on technology, scale, labor, and location.

Investment Considerations

Solar projects require a 10-15 year investment horizon, with guaranteed cash flows during this period. Post-guarantee, energy prices are hard to predict, so investments should aim to recover costs within the guaranteed period. Key factors affecting returns:

- Construction/purchase cost.

- Investment timeline.

- Expected electricity prices.

- Electricity production volume (depends on sunlight, equipment quality, maintenance).

- Operating expenses.

- Financing source.

PNTV Services

PNTV provides comprehensive support for renewable energy projects:

- Financing for solar, thermal, wind, substations, and more with a 10% minimum contribution.

- Engineering design, construction, and financial modeling.

- Contact us for a free consultation via email with your project brief.