Financing Waste Treatment and Waste-to-Energy Projects

Constructing waste processing and waste-to-energy (WtE) plants requires significant investment, often tens of millions of euros, posing challenges for companies and public sectors facing funding shortages. WtE facilities convert municipal solid waste into energy (electricity, heat, or fuel) via incineration, gasification, or anaerobic digestion, offering dual benefits of waste reduction and energy production. Innovative financing models like project finance (PF) and public-private partnerships (PPPs) attract external capital while minimizing financial risks.

Funding Challenges

Waste management and WtE projects face high costs due to advanced technologies and infrastructure needs. Investors remain cautious due to long payback periods and regulatory uncertainties, while public sectors often lack funds, stalling initiatives. Flexible funding models are essential to bridge this gap and ensure sustainable waste management and energy production.

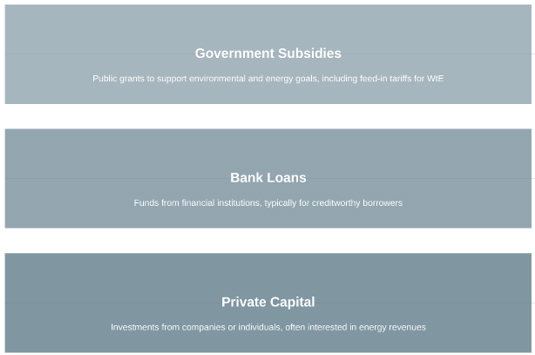

Financing Sources for WtE Projects

Bank Financing Options

- Business Loans: For entrepreneurial projects like WtE plant construction.

- Bridging Loans: Short-term financing during construction phases.

- Bonds: Long-term debt instruments sold to investors, often used for energy infrastructure.

Bank loans suit smaller projects or municipalities but can burden small firms with stringent requirements, especially for WtE projects requiring high upfront capital for technology

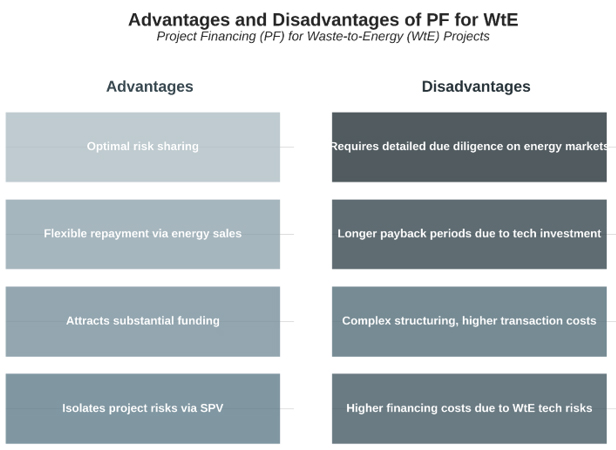

Project Finance (PF) for Waste and WtE Projects

PF, originating in the 13th century, became prominent in the 1980s for infrastructure projects. It suits large-scale waste processing and WtE plants by leveraging future cash flows (from waste tipping fees and energy sales) rather than sponsor assets, isolating risks via Special Purpose Vehicles (SPVs).

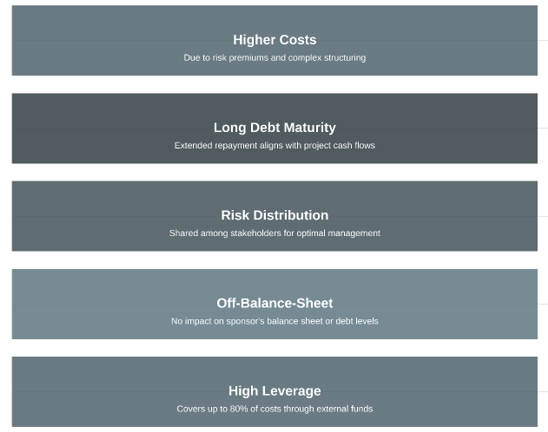

Key Features of Project Financing for Waste and WtE Projects

WtE Financial Considerations

WtE projects add complexity to PF due to technology costs (e.g., €50–100M for a medium-scale incineration plant) and revenue uncertainties tied to energy market prices. However, they offer stable cash flows from energy sales and tipping fees, making them attractive for PF. Risks include regulatory changes (e.g., emissions standards) and public opposition, which can delay projects and increase costs.

- SPV: Independent entity managing project assets and debts, crucial for isolating WtE revenue streams.

- Sponsors: Initiate and conduct feasibility studies, often including energy firms.

- Lenders: Provide funds (banks, development organizations), reassured by WtE’s dual revenue model.

- Contractors: Handle construction and operations, specializing in WtE technologies.

- Consultants: Offer financial, legal, and technical expertise, assessing WtE tech viability.

- Government: Ensures public interest, facilitates permits, and often provides energy subsidies.

Participants and Roles

Public-Private Partnerships (PPPs)

PPPs involve long-term collaboration for waste management and WtE projects. Benefits include:

- Public Sector: Focus on regulation while private firms manage risks; WtE projects align with energy and waste goals.

- Private Sector: Access to funding, high repayment guarantees, and energy market opportunities via tenders.

PPPs accelerate WtE implementation by leveraging state support for permits and energy grid access. For example, a PPP might involve a private firm building a WtE plant under a 20-year contract, with the government guaranteeing waste supply and energy purchase agreements.

Trends and Insights

- PF accounts for half of capital investments in large projects in developed countries, including WtE.

- Post-2008, the secondary market for project debt diminished, impacting securitization.

- Governments prioritize waste management and renewable energy, encouraging private investment in WtE to reduce budget deficits.

- WtE projects thrive in regions with high waste volumes and energy demand (e.g., Europe, Japan), supported by policies like EU renewable energy targets.

- PF suits WtE projects with reliable long-term contracts for waste supply and energy offtake.

PNTV Services

PNTV offers comprehensive financial and engineering solutions for waste and WtE projects globally (Europe, Latin America, Middle East, South Asia). Services include:

- Financing up to 80% of project costs, including WtE technology investments.

- Customized PF models for dual-revenue streams (waste fees, energy sales).

- Support at all stages, from feasibility to operation, with expertise in WtE tech integration.

Contact PNTV advisors for tailored solutions or to submit a project brief.